Elder financial crimes totaled $27 billion in one year, a criminal practice that largely affects both Whites and people of color in the country.

From June 2022 to June 2023, 155,415 filings were recorded, indicating more than $27 billion in suspicious Elder Financial Exploitation (EFE) activity, according to an analysis released by the U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN).

FinCEN analyzed data from the Bank Secrecy Act (BSA), revealing both actual and attempted transactions totaling in suspicious EFE activities. According to the authority, losses from these schemes impact victims' personal savings, checking accounts, retirement savings, and investments, severely affecting their well-being and financial security.

The authority further classifies EFE cases into two primary subcategories: Elder theft involves the illicit misappropriation of a senior's assets, funds, or income by a trusted individual. On the other hand, Elder scams entail the duplicitous transfer of money to a stranger or impostor in exchange for a promised benefit or good that the older adult will ultimately never receive.

Elder scams constitute the bulk of suspicious activity reports in Elder Financial Exploitation. Two prominent practices within this subcategory are tech support scams and romance scams.

Various factors contribute to romance scam victimization, including declining cognitive abilities, loneliness, grief from the recent loss of a loved one, or the belief that they are entering a relationship with a wealthy individual. -FinCEN

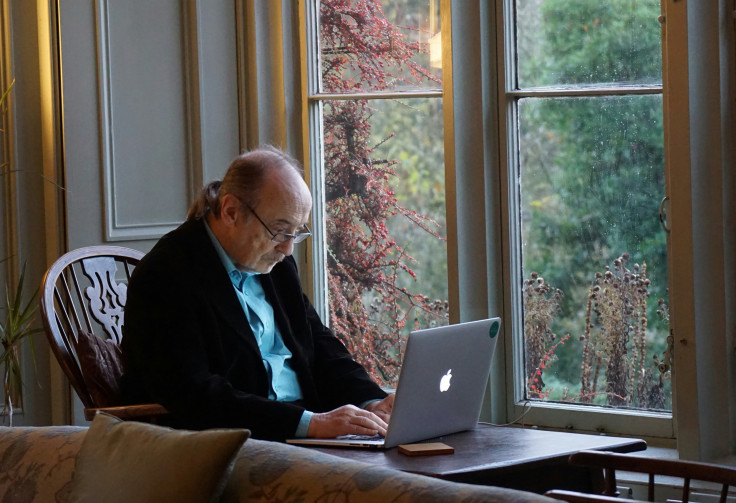

Tech support scams primarily rely on social engineering tactics. Victims often receive a deceptive alert on their devices, falsely indicating a virus, prompting them to call a fraudulent call center. According to FinCEN, victims then interact with a representative impersonating a reputable computer company, who proceeds to conduct fake "repairs" and charges the victim. Moreover, victims often grant the scammer remote access to their computer, which can result in the installation of malware or compromise of personally identifiable information.

In the case of romance scams, the authority notes that scammers most commonly contact victims through online dating platforms. Various factors contribute to romance scam victimization, including declining cognitive abilities, loneliness, grief from the recent loss of a loved one, or the belief that they are entering a relationship with a wealthy individual."

Romance scams can follow several different patterns and can also turn into investment scams once a connection is established.

"FinCEN has long recognized the threat that Elder Financial Exploitation poses and the need to protect the older adult population from financial abuse," said FinCEN Director Andrea Gacki.

According to a report by the National Institute of Justice, 79.7% of victims over the age of 60 who have experienced personal financial fraud are White, followed by 9.5% Hispanic and 7.8% Black. Additionally, 56% of victims are female, and 44% are male.

On the other hand, the AARP, which serves retirees, states in a report that Latino adults are the primary targets of government imposter scams, utility scams, and grandparent scams. Latino adults far outnumber other racial groups in both utility and grandparent scams. Other work-related scams such as bogus work-from-home offers, fake job postings, and lottery scams rank among the top ten scams targeting this population.

© 2024 Latin Times. All rights reserved. Do not reproduce without permission.

Some Chicagoans are so outraged over a $70 million aid package for migrants that they want a mayoral recall

Financial fraud, romance scams skim U.S. elders of 27 billion in one year

Trump's top concern on first day of his criminal trial: Not attending his son's high school graduation

Former NFL Star OJ Simpson, Acquitted of Murder, Passes Away at 76 After Battle with Cancer