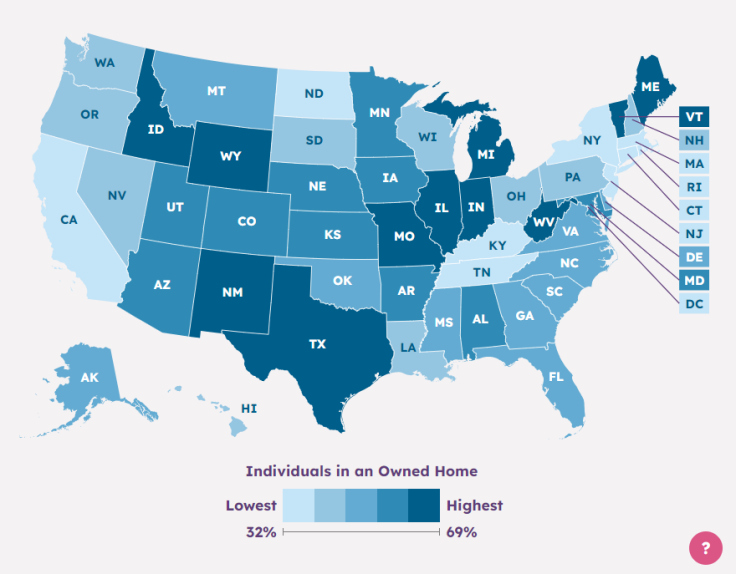

The proportion of Latino homeownership in U.S. states varies widely. Almost seven out of every ten Latinos living in New Mexico, West Virginia and Vermont are homeowners, while the figure drops to less than a third in New York.

The information from Latino Data Hub shows that the country average from the 2021 Census Bureau data is 52 percent, the concrete number being 31,359,000 people at that time.

While the figure has climbed since then, with different reports showing that the demographic is among the ones with the most purchases of the kind, the tool also shows the states in which they have been the most prolific.

States with higher numbers or proportion of Latinos in the countries show varying scenarios: besides New Mexico (69 percent), Latinos from Texas (62 percent), Arizona (60 percent) and Florida (55 percent) are above the national average. Nevada (51 percent) and California (47 percent) are among those below.

New York is, by far, the state with the lowest proportion of Latino homeownership in 2021, with 32 percent. This scenario was illustrated by a recent report from state Attorney General Letitia James, showing that White households own homes at nearly double the rate of households of color.

The report detailed systemic barriers for people of color when applying for mortgages: it showed that they were rejected at higher rates than Whites regardless of credit score, income, size of the loan, among other factors. Even non-white people with the highest credit scores were denied mortgages at nearly double the rate of white applicants.

In addition to higher rejection rates, the report found that Black and Latino borrowers face higher costs when buying a home. They were found more likely to be charged higher interest rates for their loans, more likely to use costlier Federal Housing Administration loans, and less likely to be approved to refinance their loans to a lower rate. The report found that these higher interest rates, as a whole, cost Black and Latino borrowers over $200 million more in interest than white borrowers.

However, beyond New York, Latinos are still buying homes. Seven percent of all homebuyers in the United States last year were Latinos according to a report by the National Association of Realtors (NAR) published in mid-November.

And according to another report by the the National Association of Hispanic Real Estate Professionals (NAHREP), there have ben eight years of consistent homeownership growth" despite affordability challenges. Latinos were the only demographic with this streak, according to the report.

It also highlighted that the median age of Latino homebuyers was 30. The age was lower than the average documented by the NAR report, which showed that the typical age for first-time buyers was 35 years.

But the situation is not the same for all Latinos. A report from from the National Women's Law Center showed that this goal more difficult to achieve for Latino women, who have a harder time being approved for home loans. The report analyzed ownership between 2007 and 2021 and found that women of color are less likely to be homeowners today than they were 14 years ago.

According to the report, in 2007, 39.8% of single Latinas living alone were homeowners, but in 2021, that number dipped slightly to 38.8%. In comparison, 55.6% of single, non-Hispanic men were homeowners in 2007, and that number grew to 57.2% in 2021.

The study also analyzed homeownership among single adult families raising at least one child and found that disparity was even greater for Latinas.

According to the data, in 2021, only 28.2% of single Latinas with one child were homeowners. In contrast, 63.6% of single white men with one child were homeowners, and almost half of single white women with one child were so.

© 2025 Latin Times. All rights reserved. Do not reproduce without permission.

![Real Estate, door [Representation Image]](https://d.latintimes.com/en/full/497685/real-estate-door-representation-image.jpg?w=120&h=60&f=6a2fa6ffda9fa8aa1b7e9eb6187a4264)