Only 34% of Hispanics believe they are saving enough or have saved enough for retirement, six points lower than the national average, according to a report by an insurance industry research company.

According to LIMRA, 50% of Hispanics say they worry about having enough money for retirement and The Latin Times, in conversations with several Hispanic workers and financial advisors, found out that there is a growing concern among members of this community regarding resources for a life after giving up work.

"You run out of options if you don't have any assets other than social security. It may be that at some point you're not able to stay in your home, it may be that you end up becoming a burden on your kids or other family members, or other times you don't have enough to take care of yourself," David Alvarez, financial advisor at Pax Financial Group said. "With a lot of the families I work with, what they want to avoid the most, is being a burden on others. Not planning enough for that future is putting yourself in a higher likelihood of becoming a burden on other people."

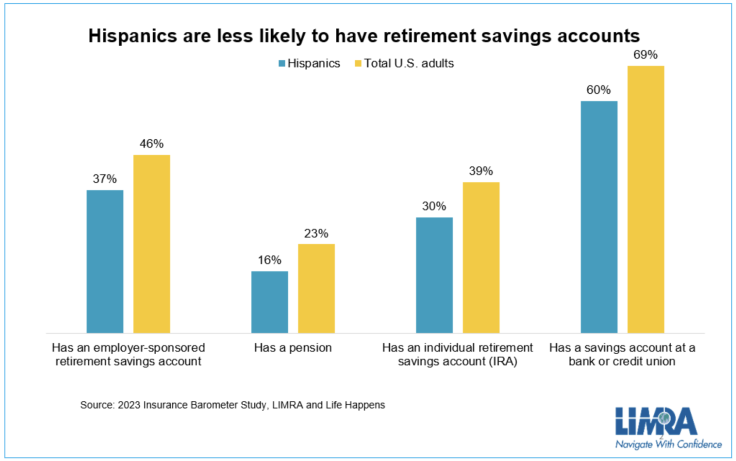

LIMRA pulled data from their 2023 Barometer Insurance study and found that Hispanic adults seemed financially stressed in their day-to-day lives. The LIMRA report said Hispanics were more likely to worry about job security, monthly bills and managing future unforeseen expenses than other groups.

Growing up Hispanic and Planning for Retirement

Marisol Hernández, 35, was born in Mexico but has lived in the U.S. for most of her life. Hernández said she has a job that allows her to live comfortably, and now she's begun to build up savings for her retirement. Despite this, she said growing up, retirement was never talked about.

"It's kind of like Maslow's hierarchy of needs," Hernández told The Latin Times in reference to the most important needs a person has (physiological, safety, love and belonging, esteem, and self-actualization). "Retirement is really at the top point of it, and it's what my family really needs to solve are basic problems, like keeping a roof over our head, making repairs to our house that was an almost historic residence. It was built, I think, in the 40s (...) They just focused on putting food on the table and making sure the house was in working order, and we didn't talk about vacations, 529s, 401ks, the conversations were always just how are we gonna get through the end of the month."

Hernández says that she went to college and got a degree, and then, after some luck, she found a well-paying job where she could max out her 401k and Health Savings Account. She said because of her early investments, when she retires, she will be able to live a comfortable middle-class life.

Many Borders to Cross

Steve Castillo, 40, was born in Los Angeles but has lived in Las Vegas for most of his life. His roots are Salvadorean and Mexican, and out of about 250 people in his family network, he said only three of them have college degrees. He said his family never really talked about planning for retirement due to ignorance, but when his father fell on hard times, he realized the importance of planning for the future.

"I was 33, [when] in 2016 my dad was let go from a construction company where he was a plumbing foreman, and I realized how dire the situation must have looked for him without education, with basically just his worth as his experience, and his name as a person who was thorough with his work," Castillo said. "So when he was let go from that position, he struggled to pay the mortgage, so I helped him pay out the remainder of his house. That's when it hit me. I might have thought about it before, but the seriousness, the reality of it hit me about seven years ago."

Growing up, Castillo said his parents focused on the bare minimum—food, clothes and a roof over their head. As many Hispanics in the U.S. who are immigrants, they focus on taking care of their family either here or those who still live in their country of origin. Because of this, they don't have the chance to save money for retirement.

Castillo said he now puts as much as he can in his 401K, has some money in the stock market, and has a pension he got from getting hurt in combat while in the Army. All of his retirement investments now enable him not to worry, Castillo said. He said he understands his family did what they could, but moving forward, he wants to educate on financial literacy.

"I have the college degree, but I'm 40 now, so I think that if our parents were able to invest in our future, and maybe not necessarily through financing for college, but just information on how to get financed," Castillo said. "I took on a bunch of scholarships where it was as simple as 'Are you a minority, do you have kids, are you in the military? Fill out an essay, then the best essay will be awarded $3,000 towards college tuition.' I think we're kind of behind the curve. We're kind of disadvantaged in not having all the information available to us, whether or not it was financial."

The Importance of Being Able to Save

Alison Alvarez, 43, a Cuban American, says that among her family retirement was never a frequent topic, but they always spoke about the importance of saving money, and she was aware that her family was working towards a stable retirement fund. Aside from that, she said money was a hot topic at home, whether it be about budgeting or spending too much.

"Financial insecurity is a generational trauma inside the Cuban community, so you always have to be hyper-aware that you could lose everything at any minute," Alvarez said. "When my family left Cuba, the one thing they were able to take with them was maybe some money they hid in their shoes. Otherwise, you couldn't really take anything of value with you."

Now, Alvarez said, she never worries about finances, and she actually worries about how she can help her extended family. She founded the tech company Blast Point, which uses artificial intelligence to predict human behavior. She said although things are going well financially, she is always thinking about saving for the future and taking care of her retirement accounts consisting of a 401K, Roth IRA, cash savings and index funds.

What do Financial Advisors Say About Retirement Planning?

David Alvarez, financial advisor at Pax Financial Group, said one of the most important things is to start planning for retirement early because the power of investing is exponential over time. He said if people start planning for retirement later in life, it requires extra planning thoughtfulness, but he said budgeting is key.

"I know it's not a fun thing to think about, but most Americans don't have a budget. They just kind of spend money until they don't have money to spend anymore. When you're getting close to retirement, it's really important to know how much money you need on a monthly basis, and on a high level, how much do you actually need, and how much would you like to have," Alvarez said, adding that the needs are things such as insurance, mortgages, and groceries while things such as dining, traveling, and gifts are wants.

He said the best bet for people just starting retirement savings is to put money into their 401K through their employer. Those are good if the employer does an investment match on 401K's, but if not, he said a high-yield savings account could be attractive with interest around 5% or things such as ROTH IRAs.

On top of investing in retirement savings, he said he tells his clients that the most important thing is to have at least six months of emergency savings.

Managing director at Wolfpack Wealth Management, Leyder Murillo said that one of the most important things is to manage one's spending through cutting out unnecessary purchases.

"Usually, I like to tell clients and potential clients to have the mindset of thinking about sacrificing something now for a future benefit. If you can master this mindset, it will make things easy when it comes to budgeting, and it will make you rethink impromptu one-off unnecessary purchases," Murillo said. "In a time where it seems like living paycheck to paycheck is the constant feeling it's usually overspending on things that are not necessary and can often be cut out to just sacrifice something today for the benefit of it in the future."

Investment Reluctance Among Latinos

Murillo said that among the Latino community, there can be barriers to investing due to mistrust of the financial industry, which he attributes to to a lack of representation and understanding.

"A critical factor to highlight is the financial literacy gap within the Latino community. Lack of financial education is a significant barrier, hindering our community's ability to make informed decisions about saving and investing for retirement. Addressing this gap is imperative for empowering Latinos to secure their financial futures," Murillo said.

According to Alvarez, about 50%, if not more, of his clients are Hispanic, and often, there is a language barrier to the knowledge of investing in retirement. He explained that saving for retirement is already complicated, but for someone whose first language is Spanish, not having access to information in their native language can create a barrier.

David Alvarez's family is from Cuba, and he expressed a similar sentiment as Alison Alvarez, saying that some Latinos have lost a lot in life, so they're weary when investing. Additionally, he said there can be a distrust of financial institutions, and some Latinos don't understand investing, so they decide to do nothing.

"(There are) a lot of families who are really just struggling to make ends meet on a month-to-month basis. So, the idea of putting money in a 401K for a couple who, let's say they're in their 30s or 40s and they have kids, doctor bills, and utility bills are twice what they were, it's hard enough to keep up with that stuff. They can't afford to see their paycheck go down (...) That's what they see if they put money in their 401K, their paycheck goes down, and so it can be a combination of what they may see as something they don't understand and also the reality that they need every dollar that comes to them."

© 2025 Latin Times. All rights reserved. Do not reproduce without permission.